Chapter 3: General Provisions, Section 9: Payment

- 3-901 General

- 3-902 Measurement

- 3-903 Force Account

- 3-903A Authorization for Force Account Payment

- 3-903B Force Account Records

- 3-903C Tentative Agreements

- 3-903D Markup for Subcontracted Work

- 3-903E Owner-Operated Labor and Equipment

- 3-903F Billing for Extra Work at Force Account

- 3-903G Labor

- 3-903H Material

- 3-903I Equipment Rental

- 3-903J Extra Work Performed by Specialists

- 3-904 Payment Adjustments

- 3-905 Time-Related Overhead

- 3-906 Progress Payments

- 3-907 Payment After Contract Acceptance

- 3-908 Arbitration

Section 9 Payment

3-901 General

This section covers measurement and payment of bid item work and change order work, partial payments, and payment to the contractor after contract acceptance. The contract provides the following methods to make payment for all work performed:

- Payment for bid item work at unit prices. The contractor establishes the fixed prices of the bid items included in the contract. Fixed prices of bid items should not be confused with the costs to produce the work. Loss of profit, damage, repair, cost escalation, or other unanticipated changes of item costs are the sole responsibility of the contractor unless specifically provided for in the contract.

- Adjustments to contract prices, known as payment adjustments.

- Payment for change order work. Before payment can be made for change order work, the resident engineer must issue an approved change order as described in Section 5-3, “Change Orders,” of this manual. For additional information regarding Caltrans policies on change order work, refer to Section 3-403, “Changes and Extra Work,” of this manual. The methods specified for paying for change order work are bid item prices, force account, agreed price, and specialist billing.

- Deductions and withholds are temporarily or permanently taken from monies due under the contract.

3-902 Measurement

Contract work, as bid on by the contractor, is measured and paid for as bid items. Bid items are measured for payment as units. The unit for each bid item is shown in the bid item list as “unit of measure.” Bid items may be measured by units of count, length, area, volume, weight, or lump sum. The bid item list also includes the estimated quantity of each bid item. Resident engineers and assistant resident engineers must determine, by measurement and calculation, the quantities of the various bid items actually performed by the contractor.

3-902A Method of Measurement

Check the “measurement” and “payment” clauses in the specifications for the required method of measurement for each bid item. Use the specified method to measure quantities. For more information about measuring quantities for specific bid items, refer to Chapter 4, “Construction Details,” of this manual.

A change in the unit or the method of measurement changes the contract. Do not change the unit or the method of measurement unless the change is provided for in a change order.

3-902B Accuracy

Measure and calculate bid item quantities to a degree of accuracy consistent with the unit price of the item. Give early consideration to the accuracy desired so that all personnel on a given project will measure and calculate uniformly. The general rule is to measure to a degree of accuracy that, when calculated, the resulting value will be within 0.2 percent to 0.5 percent. A $50,000 item should be measured and calculated to result in payment within about $100.

3-902C Source Documents

Enter measurements and calculations for bid item quantities on permanent record sheets that are commonly referred to as “source documents.” Include on each source document the appropriate bid item number, the location of installation if applicable, the necessary measurements and calculations, and the name of the person preparing the document. Check source document calculations independently, and enter the name of the checker on the document.

Check source document calculations as soon as possible, preferably before the quantity is entered on a progress pay estimate. Always check them before entry on the proposed final estimate. Whenever possible, measure, calculate, and check bid item quantities as the work on a bid item is completed. Resident engineers must assign responsibility for checking calculations to assistant resident engineers in the same manner that other project responsibilities are assigned.

Enter into the system for progress payment the quantities from the source documents. For a description of the progress payment process, refer to Section 5-1, “Project Records and Reports,” of this manual.

3-902D Audit Trail

State the source of any figure, calculation, or quantity shown on the source document. For instance, a quantity may be the result of a field measurement, scale weights, a count, or a calculation based on planned dimensions.

Create a clear and easily followed trail for the total pay quantity in the proposed final estimate back to the first measurement or calculation for each bid item.

Consider organizing source documents for each bid item so an easily followed audit trail exists. Category 47, “Drainage Systems,” in Section 5-102, “Organization of Project Documents,” of this manual, provides guidance, especially for large projects, for organizing source documents for drainage related bid items. Category 48, “Bid Item Quantity Documents,” in the same manual section, describes the numbering system to be used for source documents for other bid items.

3-902E Weighing Equipment and Procedures

The following describes the duties and responsibilities of the people involved in weighing and measuring materials and the procedures for assuring accurate weighing and measuring:

3-902E (1) Personnel

The process of determining bid item quantities by weighing and measuring includes the following personnel:

- The resident engineer

- Assistant resident engineers

- The district weights and measures coordinator

- The Division of Construction weights and measures coordinator

In addition to Caltrans personnel, the following people are involved in the weighing and measuring process:

- County sealers of weighing and measuring devices

- Representatives of the California Department of Food and Agriculture, Division of Measurement Standards

- Private scale technicians performing Material Plant Quality Program (MPQP) testing

3-902E (2) Responsibilities

All Caltrans personnel must be alert for conditions that contribute to failure to obtain the accurate weight and measurement of materials. The following describes the typical duties and responsibilities for verifying compliance with the specifications for weighing and measuring:

3-902E (2a) Resident Engineers

The resident engineer must do the following:

- Verify accurate weighing and measuring through inspection.

- Routinely determine that proper weighing procedures are used.

- Record, or verify recording of, spot-checks of weighing procedures in daily reports.

- Require the contractor to correct any malfunctioning weighing or measuring device.

- Order the resealing and retesting of scales and meters as often as necessary to assure accuracy.

- Determine when weighmaster certificates are to be used. Order the use of weighmaster certificates except when the number of loads is very small or conditions preclude proper weighing procedures. In the daily report, record the reasons for not using weighmaster certificates.

3-902E (2b) District Weights and Measures Coordinator

The district weights and measures coordinator must do the following:

- Provide technical assistance to the resident engineer and assistant resident engineers.

- Provide information to resident engineers regarding the adequacy of scales and the validity of seals.

- When requested by the resident engineer, witness the testing of scales or meters in compliance with the requirements of the MPQP.

- Furnish copies of the MPQP report to each project using material plants tested in accordance with the

- Furnish and attach an MPQP Approval Sticker to tested scales.

- Maintain a file on the current status of all scales that are commonly used for weighing materials for Caltrans projects in the district.

- On request, provide scale status information to adjacent districts.

- Perform spot-checks of weighing and measuring devices and procedures in the district, and furnish written reports to the resident engineer.

- Determine whether any weighing or measuring problems should involve the California Department of Food and Agriculture, Division of Measurement Standards. Request any such involvement through the Division of Construction weights and measures coordinator.

3-902E (2c) Assistant Resident Engineers

Assistant resident engineers act for the resident engineer and, depending on the authority delegated to them, do the following:

- Observe the installation of scales installed primarily for use on a given project. Decide whether such scales and appurtenances meet the requirements of the specifications. When necessary, request assistance from the district weights and measures coordinator.

- Inspect and observe the general condition of all scales used on the project. If the scales are in questionable condition, request advice from the district weights and measures coordinator.

- Request a material plant approval report from the district weights and measures coordinator. If a seal or approval sticker is not valid, require the contractor to have the scales tested before use.

- Witness scale testing. Determine that the scales have been tested to the capacity for which they are being used on the project. Request that the district weights and measures coordinator observes the procedure.

- Whenever a scale is moved, overhauled, or shows obvious deficiencies, require the scale to be restored to normal operating condition and then retested.

- To observe the weighing of materials, visit the scale house or plant periodically. If necessary, request technical assistance from the district weights and measures coordinator. Check the scale sheets and weighmaster certificates to verify that they are being used properly.

- Spot-check tare and gross weights to see that weighmasters are using the correct tare. Verify that the weighmaster is licensed for the scale location.

- Observe all meters that are required under the contract, and verify that they have been tested and sealed.

- Collect weighmaster certificates at delivery. A Caltrans employee should be present at the work site to collect weighmaster certificates. Sign or initial the weighmaster certificate to indicate that the represented material was used in the work.

When certified summary scale sheets are used, and weighmaster certificates are not used, verify that material shown on the summary sheets has been used in the work. Do this verification by using a tally sheet, a spread record, or a random check. In the daily report, record that the material has been used in the work and the type of verification method. Sign the summary scale sheets to certify that the represented material, less any material deducted from the total, was used in the work.

Return to the contractor a copy of any weighmaster certificates or scale sheets representing loads or partial loads that are not to be paid for. On the weighmaster certificate or scale sheet, indicate the quantity of material not included for payment. Retain a copy for the project records. When a determination is made to reduce the quantity, advise the contractor’s foreperson or superintendent of the amount and reason for the reduction. In the daily report, note the reduction and the name of the contractor’s employee whom you advised of the reduction.

3-902E (2d) Contractors

The following describes some of the duties and responsibilities of contractors and their agents in using scales and measuring devices for measuring and proportioning materials:

- The contractor and materials suppliers must maintain scales and meters within the accuracy specified.

- The owner of the scale or meter must maintain it in good operating condition at all times. If breakdowns or suspected inaccuracies occur, the owner must make repairs. After repairing a commercial device, the owner must notify in writing the county sealer of weights and measures that a repair was made. The device must be resealed before it is used to weigh materials for payment. For noncommercial devices, the contractor must verify that the MPQP test is performed. The contractor must notify the resident engineer at least 24 hours before any scheduled testing so that the testing can be witnessed.

Do not directly contact the county sealer of weights and measures for the contractor. The owner of the measuring device must request the testing. The resident engineer may only inform the contractor that such testing is necessary.

The district weights and measures coordinator may contact the Division of Construction weights and measures coordinator on any question regarding the validity of a seal or the legal capacity of a scale.

3-902E (2e) Division of Construction Weights and Measures Coordinator

The Division of Construction weights and measures coordinator does the following:

- Oversees that the weights and measures program is operating satisfactorily throughout Caltrans.

- Serves as a contact between the district weights and measures coordinators and the California Department of Food and Agriculture, Division of Measurement Standards.

- Keeps the district weights and measures coordinators informed of the latest equipment and technology being developed throughout the industry.

3-902F Final Pay Items

Section 9-1.02C, “Final Pay Item Quantities,” of the Standard Specifications, defines and specifies the procedure for calculating pay quantities for final pay items.

3-903 Force Account

The force account method, used to determine payment for extra work, consists of adding specified markups to the actual cost of labor, equipment, and material used to perform the extra work.

Section 9-1.04, “Force Account,” of the Standard Specifications specifies the force account method of payment. Section 5-3, “Change Orders,” of this manual contains guidance for change orders with payment for extra work at force account. See change order examples at:

https://dot.ca.gov/programs/construction/change-order-information

Normally, the contractor will use labor and equipment that is on the site and used for work in progress. The change order will usually specify materials to be used in the extra work. However, before the work begins, the resident engineer should discuss with the contractor the labor, equipment, and materials to be used. The resident engineer can avoid misunderstandings and inefficiencies by knowing the resources to be used ahead of time. After the work is performed, Caltrans must pay the contractor for material used and at the appropriate rates for the number of hours that labor and equipment was used.

3-903A Authorization for Force Account Payment

On the authorizing change order, always show the amount to be paid for extra work at force account as an estimated amount. For the format for change orders, refer to Section 5-3, “Change Orders,” of this manual. You may make payment for extra work in excess of the estimated amount shown on the contract change order up to 100 percent of the estimated amount or $15,000, whichever is smaller. To authorize any additional payment, use a supplemental change order.

3-903B Force Account Records

On daily reports, record observations and inspections of extra work in progress in sufficient detail to provide a reasonable basis for agreement on payment. Records must be original, not a copy from other documents.

Include the following information when appropriate to the method of payment for the work:

- Description of work performed. This description must be consistent with the description of extra work authorized by the change order.

- Time and date of inspection.

- The change order number.

- Location of work.

- Types of labor, equipment, and materials used.

- Estimated hours worked.

- General measurement or amount of work accomplished.

Make entries on the day of observation. If clarifying reports are necessary to cover work not previously reported, state the facts as known and date the clarifying report as of the day it is written.

The daily report must also contain a reference to any known off-site work.

When extra work is performed at force account, decide whether the magnitude of the work warrants the full-time presence of an assistant resident engineer. An assistant resident engineer assigned full time must include in the daily report the number of hours actually worked at the site. When an assistant resident engineer is assigned only part-time, daily reports must present only known facts. On the daily report, record that inspection was “intermittent.” A typical entry might read as follows:

"Hours reported on report dated 6/26/20 entry based on 1 inspection during the day. Later found out that crew and equipment worked whole shift instead of half shift (add the date of the supplemental entry and sign the entry)."

Include notations concerning decisions to allow or deny payment for work that may be in dispute or not considered a legitimate part of extra work. Similarly, prepare a supplemental daily report if it is later found that the number of hours or labor and equipment was substantially different than recorded on the original daily report. Such a supplemental daily report might read as follows:

"6/24/20 – 10:15 a.m. – Change Order No. 17 – Placing Riprap Lt. of Sta. 500.

Crew of 2 laborers and foreperson with a D-6 crawler tractor with side-boom and operator laid about 150 sq ft of salvaged rubble riprap. Estimate crew and tractor worked about 4 hours."

3-903C Tentative Agreements

Do not give copies of daily reports to the contractor’s personnel. Do not permit the contractor’s personnel to sign or initial daily reports. However, at the earliest possible time, reach tentative agreement on extra work details with the contractor’s foreperson. Discuss labor, equipment, and materials at the end of each shift or no later than the following shift that extra work was performed. Good communication at this time will help to prevent misunderstanding and arguments over details at a later date. Use Form CEM-4907, "Tentative Daily Extra Work Agreement," for this purpose. On this form, tentatively agree to and list hours of labor and equipment used in extra work at force account for each change order each day.

3-903D Markup for Subcontracted Work

Section 9-1.04A, “General,” of the Standard Specifications includes an administrative markup for the prime contractor when a subcontractor performs the work.

When an engineer’s cost analysis is based on force account, using rates as specified in the contract, include a markup in the calculation of the work performed by a subcontractor in the following situations:

- Changes and extra work at the agreed prices in accordance with Section 4-1.05A, “General,” of the Standard Specifications.

- Work performed before item elimination in accordance with Section 9-1.06D, “Eliminated Items,” of the Standard Specifications.

- Bid item adjustment because of increased or decreased quantities in accordance with Section 9-1.06B, “Increases of More Than 25 Percent,” and Section 9-1.06C, “Decreases of More Than 25 Percent,” of the Standard Specifications.

- Payment adjustments for work-character changes are made in accordance with Sections 4-1.05B, “Work-Character Changes,” and 9-1.15, “Work-Character Changes,” of the Standard Specifications.

3-903E Owner-Operated Labor and Equipment

For owner-operated labor and equipment, refer to Section 9-1.04A, “General,” of the Standard Specifications. The method for paying for owner-operated equipment on a force account basis is at market-price invoice. Because owner-operators include labor and equipment markups and the labor surcharge in their invoice price, only apply the applicable administrative markup for the owner-operated labor and equipment invoice. The administrative markup to be applied to the invoice for projects with the time-related overhead bid item is 10 percent. The administrative markup to be applied to the invoice for projects without the time-related overhead bid item is 15 percent.

3-903F Billing for Extra Work at Force Account

The following are the procedures for billing for extra work at force account:

- The contractor must submit change order bills covering extra work under each change order each day that extra work is performed. The contractor must use the Caltrans internet change order billing system to submit change order bills. Refer to Section 5-103E, “Change Order Billing,” of this manual for additional information.

- Field Construction personnel must do the following when reviewing change order bills:

- Compare change order bills against assistant resident engineer’s daily reports and tentative agreements, if they are used. Make this comparison to verify the correctness of the contractor’s billing, and to avoid the possibility of a duplicate payment for the same work. For a discussion of assistant resident engineer’s daily reports and tentative agreements, refer to Sections 3-903B, “Force Account Records,” and 3‑903C, “Tentative Agreements,” of this manual.

- The contractor must include everything to be paid for on the change order bill. Do not add any items even though you know them to be legitimate charges. Instead, call the omitted items or underbilling to the contractor’s attention and document the notification. The contractor may submit a supplemental change order bill to include omitted items or underbilling amounts. Include any notifications and support documentation in the change order billing project records.

- Delete items for which the contractor is not entitled to payment.

- You may correct hours for labor and equipment downward, but not upward. Notify the contractor of such corrections and include notification and support documentation in the change order billing project records.

- Do not correct wage rates that the contractor has submitted. Reject any change order bill with incorrect wage rates. Note that Caltrans must pay for extra work at the same wage rate paid by the contractor. Do not refuse to pay a particular wage rate because it is above the prevailing wage rate.

- Correct equipment rental codes that are obviously in error, or reject the reports. Verify that the rental codes shown are for the equipment that was actually used.

- The person, whether a contractor or Caltrans employee, who makes corrections to a change order bill must print out, sign rather than initial, and date the corrected change order bill.

- Maintain a log of change order bills received and rejected.

The resident engineer must approve the change order bill to authorize payment for extra work. The resident engineer’s approval of a change order bill for progress payment certifies that payment is in accordance with contract requirements and established administrative procedures. Maintaining documentation for extra work at force account payments is critical in supporting these payments.

3-903G Labor

The markups to be applied to the cost of labor performed on force account work are specified in Section 9-1.04B, “Labor,” of the Standard Specifications, or as changed by the special provisions.

A “labor surcharge” is included in the cost of labor. The Labor Surcharge and Equipment Rental Rates (Cost of Equipment Ownership) book in effect at the time the work is performed contains the labor surcharge percentage. A general rate applies to most crafts, and the book contains several higher rates for certain crafts. The resident engineer must determine the correct surcharge percentage to be used and verify that the percentage has been entered on the change order bill.

At times, a superintendent or an owner acts as a working foreperson, or an equipment operator works at some other craft. In such situations, make payment on a “value received” basis. Payment will be made for owners or supervisory personnel at the proper rate for the work performed. For example, pay for a superintendent acting as a foreperson on force account work at the normal hourly rate for a foreperson. Do not prorate the superintendent’s weekly or monthly salary to an hourly rate. In paying for a superintendent on force account work, make the payment on a functional basis and not on a position or classification basis.

On some projects, a superintendent or project manager directs the activities of several forepersons or 1 or more general forepersons who directly supervise the forepersons. The general forepersons are sometimes referred to as superintendents, such as grading superintendents or paving superintendents. This change in nomenclature does not change the functional nature of these positions. They are general forepersons or forepersons and are not considered to be supervisory or overhead personnel. Make payment at the actual hourly rate paid by the contractor when such personnel function as forepersons on force account work.

When paying for salaried personnel, do not authorize force account payment for overtime hours unless the contractor has an established practice of paying overtime to salaried personnel. The usual case is that the weekly or monthly salary covers the number of hours required by the work.

The Standard Specifications allow for payment of the actual subsistence and travel allowances paid by the contractor.

Pay per diem and travel allowances on force account only when the contractor is paying these allowances on bid item work.

When 7-day subsistence is included in labor contracts in lieu of per diem and travel time, subsistence will be paid for the entire period involved if the workers are employed full time on force account.

When workers are employed on both force account work and bid item work in the same day, prorate subsistence payments and travel allowances between the contractor and Caltrans. Base the prorated amount on the first 8 hours worked. Do not pay per diem for time worked after the first 8 hours in any 1 day.

3-903H Material

Payment for material purchased for force account work must be supported by a copy of the vendor’s invoice whenever possible. If no individual invoice is available, as in the case of materials taken from contractor’s stock, a copy of the mass purchase invoice may be used as support. If no invoice is available to support unit purchase prices, submit a statement with the change order bill. In the statement, explain how the unit prices were verified. Any invoice the contractor submits must represent the material actually used.

3-903I Equipment Rental

For equipment used for extra work paid at force account, refer to Section 9‑1.04D, “Equipment Rental,” of the Standard Specifications or as modified by the special provisions. The following are guidelines for paying for equipment rental.

3-903I (1) Equipment Selection

In accordance with Section 5-1.03, “Engineer’s Authority,” of the Standard Specifications, approve equipment used on force account work. Before giving approval, determine whether available and suitable equipment is already on the job site or whether equipment not on the job site is required. For example, a piece of equipment on the job site that can perform a given operation satisfactorily may be larger than necessary. Determine if it will be economical to use oversized equipment at its rate or to obtain equipment of the proper size. Obtaining equipment not on the job site necessitates payment for move-in and move-out expenses and for minimum rental periods. The determination may also be based on other factors, such as public safety and the urgency of the work. Availability of equipment on the job site can be determined by using daily reports, progress schedule, and other contractor-provided information. When there is no contractor-owned equipment available for use and only rented equipment is available on the job site, the engineer may approve the use of the rented equipment at the rental invoice price in accordance with Section 9-1.04D, “Equipment Rental,” of the Standard Specifications. If both contractor-owned and rented equipment on the job site are suitable and available for use, the contractor-owned equipment should be used.

Some equipment includes accessories as an integral part of the basic machine. When accessories are an integral part of the machine, the rates in the Labor Surcharge and Equipment Rental Rates (Cost of Equipment Ownership) book indicate that the accessory is included in the quoted rate. Do not make deductions for accessories on such integral equipment. For unusual situations, consult the Division of Construction. When the accessories are not integral and not necessary for the effort of the extra work, payment is only for the equipment required.

3-903I (2) Equipment Rental Rates

Labor Surcharge and Equipment Rental Rates (Cost of Equipment Ownership) contains the cost of ownership rates for most of the equipment used on Caltrans projects. However, the Division of Construction has also established cost of ownership rates for some equipment that is not in the book. These rates are available at:

https://dot.ca.gov/programs/construction/equipment-rental-rates-and-labor-surcharge

Establish rates that are not listed in the book or on the website, use the following procedure:

- Obtain a complete description of the equipment, including the manufacturer, model number, horsepower, size or capacity, and accessory equipment.

- If the equipment is nonstandard or unusual, request the following data from the contractor:

- Type of equipment, such as segmented, self-propelled, telescoping hydraulic crane, articulated, or rubber-tired roller

- Trade name

- Model and serial numbers

- Year manufactured

- Size, capacity, or both

- Type and amount of power

- Whether crawler, rubber-tire, or other

- Manufacturer or distributor; if local, give address

- Initial cost of the basic machine and attachments

- Operating requirements, costs, or both, if available or unusual

- Name of owner

- Transmit this information to the Division of Construction. The Division of Construction will establish a cost of ownership rate, codes, and effective time period and advise the district by mail, email, or fax. Use this document as the authority to pay the rate established.

- The contractor must be advised of the codes so that its billings can include them.

- For equipment not on the job site, and in special circumstances, the Standard Specifications permit a rate to be paid that is in excess of the rate listed in the Labor Surcharge and Equipment Rental Rates (Cost of Equipment Ownership) When the contractor proposes a rental rate in excess of the listed rate, verify that the equipment meets all the conditions listed in Section 9-1.04D(1), “General,” of the Standard Specifications. The higher rate will constitute a change to the contract and must be established by a change order. Use the following procedures to determine the rate:

- Obtain a written statement from the contractor. The statement must include the proposed rate and the justification that Section 9-1.04D(1), “General,” of the Standard Specifications

- Decide whether the conditions of use and ownership of the equipment meet all the specified criteria for payment of the higher rate.

- Submit a change order that provides for the proposed rate. State in the change order whether the table titled “Equipment Rental Hours” is applicable. The table appears in Section 9-1.04D(3), “Equipment Not On the Job Site and Not Required for Original-Contract Work,” of the Standard Specifications. If the equipment is used for bid item work, use the normally established rental rates for the entire time the equipment is used for extra work. Include in the change order a clause similar to the following: “In the event this equipment is subsequently used on bid item work, this rate is void.”

- Include justification for approval in the change order memorandum, and attach the contractor’s letter.

- Equipment for which the rental rate is not shown in the Labor Surcharge and Equipment Rental Rates (Cost of Equipment Ownership) book, but for which the Division of Construction established a rental rate, is eligible for the higher rate if all necessary conditions are met.

3-903I (3) Time in Operation

The engineer in the field must determine the rental time to pay for equipment in accordance with Section 9-1.04D(2), “Equipment on the Job Site,” of the Standard Specifications.

In general, consider equipment to be in operation when all of the following conditions exist:

- The equipment is at the site of the extra work or being used to perform the extra work.

- The equipment is not inoperative because of breakdown.

- The force account work being performed requires the equipment.

Use the following examples as guidelines for determining rental time to be paid for equipment.

- An air compressor is on the job site for 8 hours on a force account operation. It is actually used for only a few periods during the 8 hours, but it is impractical to use it on other work during the standby periods. Pay for the compressor and all accessories used intermittently for the entire period. The engine does not have to be running continuously during the period to qualify for payment. If the air compressor was also used on bid item work intermittently, prorate the 8 hours between the extra work and the bid item work.

- An air compressor is on the job site for 8 hours. It is used for the first 2 hours, but after those hours, it is no longer needed. Pay the rental for only 2 hours whether the contractor chooses to remove it or chooses to leave it at the site of the work. Apply the same reasoning if the time of operation occurred at any other time of the day. In this example, if a pavement breaker was needed intermittently for 2 hours and a tamper intermittently for 2 hours, pay 2 hours for each tool. If the pavement breaker is needed for the first hour and the tamper for a second hour, pay 1 hour for each. Advise the contractor when equipment is no longer needed at the site. In the daily report, record this notice and the time.

- A skip loader is used to load dump trucks; however, the skip loader is used only intermittently during the shift because 1 of the dump trucks broke down. The resident engineer allows the operation to continue because it is critical. Make payment for the loader for the entire shift. In such a situation, the resident engineer must try to do whatever is necessary to balance the operation. When balancing cannot be achieved, decide whether suspending an operation is more economically feasible than allowing it to continue.

Sometimes 2 pieces of equipment perform extra work at force account, yet the work does not require full-time use of both. In such instances, it is appropriate to accept, but not order, the use of only 1 operator for both pieces of equipment. Determine the rental time in the same manner as if each piece of equipment had a full-time operator and was used intermittently.

On extra work at force account, pay the same time for a foreperson’s pickup that you would pay for the foreperson.

3-903I (4) Equipment Not on the Job Site

In general, the contractor schedules extra work paid for on a force account basis and uses equipment available on the project. However, circumstances may require use of equipment not on the job site that must be brought in especially for the extra work. The resident engineer should make decisions regarding the type of equipment and its scheduled use. Sections 9-1.04D(3), “Equipment Not On the Job Site and Not Required for Original-Contract Work,” and 9-1.04D(4), “Equipment Not On the Job Site and Required for Original-Contract Work,” of the Standard Specifications specify the requirements for paying for the use of such equipment. These specifications apply when the contractor does not use or uses the equipment for bid item work. Change any previous payment as “equipment not on the job site” to payment as “equipment on the job site” when such equipment is used for bid item work.

Order the equipment removed from the project, pay move-out and possible subsequent move-in costs, or continue paying for the equipment during a suspension in extra work. Perform a cost analysis to determine the most cost-effective alternative. Temporary removal of the equipment to the contractor’s shop or a storage area off the project is not removal from the project. To end payment for the equipment, the resident engineer must order its removal.

3-903I (5) Non-Owner-Operated Dump Truck Rental

Section 9-1.04D(5), “Non-Owner-Operated Dump Truck Rental,” of the Standard Specifications specifies that the resident engineer must establish the hourly rate to be paid for dump truck rental. The actual hourly rate paid by the contractor or the truck broker may be the established rate if it is consistent with rates paid for the same trucks on other work. For help in establishing hourly rates, compare with rates paid for similar equipment on other Caltrans work.

3-903I (6) Standby Time

Pay standby charges for commercial delivery at the invoice rate.

3-903J Extra Work Performed by Specialists

Section 9-1.05, “Extra Work Performed by Specialists,” of the Standard Specifications, allows extra work to be performed by a specialist subcontractor that neither the contractor nor its current subcontractors can perform. In general, specialists are to be used only for minor portions of the work. The specifications also allow for the specialist work to be paid for by invoice if itemized billing is not the established practice of the specialist’s industry.

Do the following when considering the use of specialists:

- Before work begins, determine whether the work is normally done by any of the contractor’s forces. The contractor’s forces include any firms or organizations performing bid item work, including subsidiaries of such firms or organizations and subsidiaries of the contractor. Subsidiaries of a subcontractor are considered to be a part of the subcontractor’s organization. If you determine that the contractor’s forces can perform the work expediently, do not authorize the use of the specialist.

- Allow the contractor to hire a specialist only if an established firm with established rates would do the work.

- Districts must establish procedures to pre-approve invoiced billing. Invoiced billing must not be used to circumvent the force account method for determining payment.

3-904 Payment Adjustments

A payment adjustment is a monetary increase or decrease applied to the unit price of a bid item. The adjustment is a change to the contract and must be made by change order. Payment adjustments are either unit adjustments to the unit price of a bid item or they may be a lump sum increase or decrease applied to a bid item.

Payment adjustments are provided for in Sections 9-1.06, “Changed Quantity Payment Adjustments”; 9-1.15, “Work-Character Changes”; “9‑1.17C, “Proposed Final Estimate”; and 9-1.17D(2)(b), “Overhead Claims,” of the Standard Specifications. Other payment adjustments may be required, depending on the bid items, such as hot mix asphalt and concrete pavement.

Do not pay for payment adjustments until change orders authorizing the adjustments have been approved.

If you anticipate that payment adjustments in accordance with Sections 9-1.06, “Changed Quantity Payment Adjustments,” or 9-1.15, “Work-Character Changes,” of the Standard Specifications will result in decreases in final payment, withhold an amount sufficient to cover the value of the decrease.

For more discussion about determining payment adjustments, refer to Section 5-3, “Change Orders,” of this manual.

3-904A Changed Quantity Payment Adjustments

When the total pay quantity of a bid item varies from the bid item list by more than 25 percent, the variation may be the result of more or fewer units than shown in the bid item list required to complete the planned work. The variance may also result from ordered changes or a combination of both of these factors. When the variation exceeds 25 percent, adjust the compensation in accordance with Section 9‑1.06, “Changed Quantity Payment Adjustments,” of the Standard Specifications, or document in the contract records the reason for not making a payment adjustment. When the accumulated increase or decrease in bid item units shown on a change order exceeds 25 percent of the bid item list, the overrun or underrun must be acknowledged and provided for in the current change order. Refer to Section 5-306C, “Methods of Payment,” of this manual for more information on change orders. Provide for this overrun or underrun through 1 of the following options, whichever is applicable:

- Adjust the contract price in accordance with Section 9-1.06, “Changed Quantity Payment Adjustments,” of the Standard Specifications.

- Defer any payment adjustment because of the overrun or underrun.

- State in writing that the bid item is not subject to adjustment. Refer to Section 5-3, “Change Orders,” of this manual for a discussion and examples of change orders providing for payment adjustments resulting from increased or decreased quantities.

3-904A (1) Increases of More Than 25 Percent

It is usually appropriate to defer adjustment if work on the bid item has not been completed. Additional change orders may affect the quantity, or the number of units required to complete planned work may not be known. However, as soon as unit costs and final quantities can be reasonably determined, calculate any required unit adjustment and provide for it through a change order. When work on the bid item is completed, apply the unit adjustment to the total number of units in excess of 125 percent of the quantity shown on the bid item list.

Unless requested by the contractor in writing, the engineer does not have to adjust the contract price of an item if the bid item cost of the work in excess of 125 percent of the quantity shown on the bid item list is less than $15,000. However, before exercising this right, verify that Caltrans will not gain any economic benefit from an adjustment. On the other hand, make an adjustment if it would decrease cost and the amount of the decrease would exceed the cost of making the adjustment.

3-904A (2) Decreases of More Than 25 Percent

If a bid item underruns the quantity shown on the bid item list by more than 25 percent, inform the contractor in writing as soon as work on the item has been completed. Unless the contractor requests an underrun adjustment in writing, no adjustment will be made.

3-904A (3) Eliminated Items

Section 9-1.06D, “Eliminated Items,” of the Standard Specifications applies only to bid items eliminated in their entirety. Advise the contractor as soon as it is known that an item will be eliminated. Caltrans will not be responsible for costs incurred for material ordered after notification.

Write the change order providing for the elimination of a bid item to include the disposition of any surplus material. Refer to Section 3-904A (4), “Surplus and Salvaged Material” of this manual for how to handle surplus material resulting from an eliminated item that cannot be returned to the vendor.

3-904A (4) Surplus and Salvaged Material

Minor differences between quantities of material required to complete the planned work and quantities shown in the bid item list or shown in quantity summaries on the contract plans are normal operating differences. Caltrans is not liable for a surplus of material resulting from these operating differences.

If the final quantity of an item is less than 75 percent of the quantity shown on the bid item list, include any actual loss because of excess material in the costs as computed in accordance with Section 9-1.06C, “Decreases of More Than 25 Percent,” of the Standard Specifications.

Do not make any allowance for material the contractor keeps.

Caltrans recognizes that certain materials or manufactured items required for the planned construction may be unique and not usable by the contractor, the supplier, or for other projects or customers. If such materials or items become surplus by reason of an ordered change, resulting in a direct and unavoidable loss to the contractor, such loss must be compensated. Determine compensation on the basis of actual cost as provided in Section 9-1.06D “Eliminated Items,” of the Standard Specifications. The following guidelines describe how to dispose of material that the contractor cannot economically dispose of.

A determination to salvage items made surplus by ordered changes should be based on economic benefit to Caltrans, conservation of the energy and materials required to fabricate the items, or both. Base economic benefit on the following:

- The item’s condition is adequate to perform its function satisfactorily. Damage does not necessarily make an item unsuitable for salvage. Caltrans has the capability to repair some items, so investigate this approach before deciding to dispose of a damaged item. Also consider repair costs when determining the cost-effectiveness of salvaging.

- The value equals or exceeds the difference in the cost of salvaging, including hauling, and the cost of removal and disposal.

Also, an item should be salvaged if it meets 1 or more of the following conditions:

- It is a stock item with a definite, foreseeable use. Stock items include all items that Caltrans normally uses.

- It is not a stock item but can be put to immediate use or has a definite, foreseeable use. This classification would include items that can be reinstalled in the immediate project or could be installed on future projects.

- It is part of an electrical installation owned jointly with another agency, and the other agency requests its salvage.

- It can be used immediately for some other beneficial purpose.

Most districts maintain a district salvage yard or other designated areas for receiving salvaged material. Each district also has a district recycle coordinator. Before the delivery of potentially salvageable items, make arrangements with the appropriate person. Materials should not be salvaged until such arrangements are made.

3-904B Payment Adjustments for Price Index Fluctuations

Section 9-1.07, “Payment Adjustments for Price Index Fluctuations,” of the Standard Specifications specifies payment adjustments for various bid items that contain paving asphalt. The payment adjustment occurs when the California statewide crude oil price index fluctuation exceeds the threshold as described in the contract specifications. Compensation is adjusted when the paving asphalt price fluctuates from the month of the bid date to the month in which the contract item containing paving asphalt was placed. Refer to the example in Section 5-3, “Change Orders,” of this manual.

It is important to make timely payments for price index fluctuations. Increases in the cost of paving asphalt may place financial burdens on contractors and can cause projects to exceed allocated supplemental and contingency funds. The resident engineer is responsible for the following:

- Initiating a change order within 30 days of contract approval.

- Verifying that monthly payment adjustments for paving asphalt are included in monthly estimates when items that contain paving asphalt are used.

- Monitoring monthly expenditures and estimating future months of expenditures of payment adjustments for paving asphalt to avoid exhausting the project supplemental funds and contingency balance.

- Notifying the construction engineer and project manager if you anticipate the project contingency balance will be depleted so that appropriate action can be taken.

- At the time of bid, the contractor has the option to opt out of payment adjustments for price index fluctuations. Form DES-OE-0102.12A, “Opt Out of Payment Adjustments for Price Index Fluctuations,” is included in the bid book. To determine if the contractor has opted out, review the bid book for the project. If the opt out form in the bid book is not completed, then all of the requirements apply to the project. The bid book may be viewed at:

http://ppmoe.dot.ca.gov/des/oe/bidsub/post_bid_archived.php

3-904C Work-Character Changes

Before work can be considered a “work-character change,” there must have been an ordered change to the plans or specifications. If such an ordered change materially increases or decreases the unit cost of a bid item, then a work-character change has occurred. Work-character changes are not to be confused with “differing site conditions.” For a discussion of differing site conditions, refer to Section 3-5, “Control of Work,” of this manual.

When calculating the adjustment for a change in work-character, the original bid price bears no relation to the adjustment unless it can be demonstrated that the bid price actually represents the cost of the work.

3-905 Time-Related Overhead

Section 9-1.11, “Time Related Overhead,” of the Standard Specifications applies to projects that have a time-related overhead bid item. This section includes a description of time-related overhead and a description of time-related field- and home-office overhead included in the time-related overhead bid item. The contractor includes time-related overhead costs in the time-related overhead bid item. Overhead that is not related to time is included in other bid items. Any contract time adjustments made by change order will result in an equivalent adjustment to the time-related overhead bid item quantity.

The markups for force account work performed by the prime contractor on time-related overhead projects are modified in Section 9-1.04A, “General,” of the Standard Specifications.

Refer to Section 5-410, “Overhead Claims,” of this manual for information regarding claims for overhead for projects without a time-related overhead bid item.

3-905A Audit Examination and Reports

When the time-related overhead bid item quantity paid exceeds 149 percent of the quantity at time of bid, consult with your district management before requesting that the contractor provide an audit of its overhead costs. Refer to Section 5-411, “Audits,” of this manual for more information.

3-905B Payment

Time-related overhead (TRO) is compensated on monthly progress payments based on the number of working days charged during the pay period. Separate plant establishment period and permanent erosion control establishment period working days do not receive time-related overhead compensation. The quantity of time-related overhead is not adjusted for concurrent delays. The quantity of time-related overhead will be adjusted only because of critical delays or time saving adjustments that revise the current contract completion date. Adjustments to contract time are handled as follows:

- If contract time is adjusted by change order, and there are no revisions to working days charged to date, payments for increase time adjustments occurs when the original bid item quantity is exceeded.

- If you have charged nonworking days that you later determine to be a critical delay, write a change order to make a time adjustment and promptly pay for the revised working days charged to date.

- If contract time is decreased by change order, the corresponding reduction for time-related overhead is processed in the next progress estimate.

Whether TRO is bid by working day or lump sum within the bid item list, a 20 percent maximum limit is contractually established for progress payment purposes. Amounts more than the 20 percent limit are released in the estimate following completion of the contract work excluding plant establishment or permanent erosion control establishment work.

For contracts with a TRO lump sum quantity on the bid item list, calculate the amount to be paid for each working day charged within a progress payment period as follows:

Case 1 - TRO lump sum bid is less than or equal to 20 percent of total bid amount:

- TRO working day rate is the TRO lump sum bid amount divided by the original number of working days bid. Note: TRO is not paid on plant establishment or permanent erosion control establishment working days and such days are not included in the TRO working day rate calculation.

- For contract time adjustments, include corresponding unit TRO working day rate payment adjustments within the change order.

Case 2 - TRO lump sum bid is more than 20 percent of total bid amount:

- TRO working day rate is 20 percent of total bid amount divided by the original number of working days bid. Note: TRO is not paid on plant establishment or permanent erosion control establishment working days and such days are not included in the TRO working day rate calculation.

- Calculate an excess TRO working day rate that is equal to the difference of the TRO lump sum bid and 20 percent of the total bid amount, divided by the original number of working days bid. This excessive amount of TRO will be released after non-plant establishment and non-permanent erosion control establishment work has been completed in the subsequent payment estimate.

- Note that change orders with time adjustments will need 2 corresponding unit TRO working day rate payment adjustments of 20 percent maximum rate and excess rate.

For contracts with a TRO working day quantity on the bid item list, the amount to be paid for each working day charged within the pay period is the bid item price unless the 20 percent maximum limit has been exceeded. If the maximum limit was exceeded, provide a corresponding 20 percent unit rate on progress payments and release the corresponding excess unit rate amount after non-plant establishment and non-permanent erosion control establishment work has been completed in the subsequent payment estimate.

Excluding terminated contracts, if the contractor completes the contract work before the expiration of allotted contract time, which is the original number of working days and time adjustments by approved contract change orders, pay any remaining TRO item quantity balances as follows:

- For contracts without plant establishment or permanent erosion control establishment work, process the corresponding remaining working day balance on the after contract acceptance estimate. Include payment for any additional TRO compensation that was bid more than 20 percent of the total bid.

- For contracts with plant establishment or permanent erosion control establishment work, process the corresponding remaining working day balance in the first progress payment after all non-plant establishment and non-permanent erosion control establishment work is completed. Include payment for any additional TRO compensation that was bid more than 20 percent of the total bid.

If the TRO bid item quantity exceeds 149 percent of the quantity shown on the Bid Item List or as converted under section 9-1.11B, “Payment Quantity,” of the Standard Specifications, and the engineer authorizes a TRO rate through audit that differs from that bid, process a payment adjustment. Calculate the payment adjustment based on the difference in the actual TRO rate and that bid. Apply the differential rate to the quantity of TRO exceeding 149 percent threshold. Include a separate payment adjustment for Caltrans’ share of the contractor’s audit report cost as described under section 9-1.11E, “Payment Adjustments,” of the Standard Specifications.

TRO payments are not made during liquidated damage periods because contractors’ TRO during these periods is noncompensable.

3-906 Progress Payments

Section 9-1.16, “Progress Payments,” of the Standard Specifications requires Caltrans to make an estimate of work completed each month. Such estimates are designated as progress pay estimates. Each progress pay estimate must include payment for work completed up to and including the 20th day of the month. Include payment for change order bills that are submitted on time. Also include payment for extra work performed at agreed price and payment adjustments. Billing for this work must be submitted by the resident engineer during the pay period in which the work was performed.

Caltrans supports a collaborative progress payment process allowing contractor participation in estimating bid item quantities completed for progress payments. Contractor participation in this process is optional but should be determined at the preconstruction conference. When a contractor provides a submittal of estimated item quantities and supporting calculations for work completed up to and including the 20th day of the month, 2 working days before the progress payment cut-off date, the resident engineer will provide Caltrans’ estimate of item quantities and supporting calculations to the contractor. One working day before the progress payment schedule cut-off date, the contractor and resident engineer will attempt to resolve differences in the estimated quantities. If an agreement cannot be reached for a particular item quantity, the progress payment will be based on Caltrans’ estimated quantity for the item. If modifications in estimated quantities are supported, revise the Caltrans estimated quantity and supporting calculations before processing the progress payment. Where the contractor does not submit a timely monthly estimate of item quantities, omits certain item quantities, or does not provide supporting calculations, the collaborative process cannot be used. Other collaborative process arrangements that are mutually agreeable to the contractor and Caltrans may be established.

Resident engineers must transmit to the district Construction office the documents and information required to prepare progress payment vouchers. All documents must be in the district office no later than the date established by the district, usually no later than the end of the contract time start day after the 20th of each month.

District Construction must arrange a schedule with the Division of Construction that will accommodate the Division of Accounting.

A monthly estimate and payment must be made if any amount of money is due the contractor.

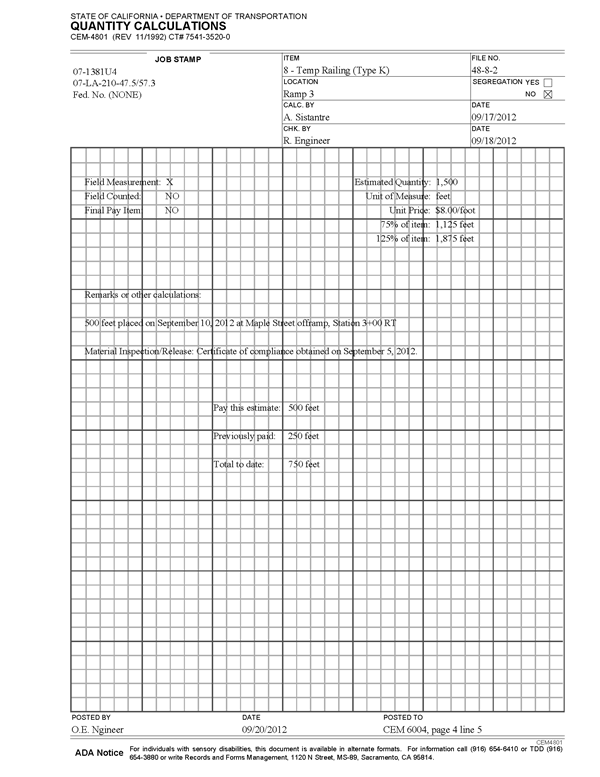

Show all quantities submitted for payment on source documents. Typically, Form CEM-4801, “Quantity Calculations,” is used for this purpose. Form CEM-4801 is shown in Example 3-9.1. at the end of this section. The estimate must reflect the totals on the source documents. A source document is defined as the basic document executed to record or calculate quantities, percentages of lump sums, or extra work for payment. Refer to Section 3‑902C, “Source Documents,” in this manual for a discussion of source documents. Example 3-9.1., “Quantity Calculations,” is a sample of a source document.

The quantity shown on the estimate for a bid item must agree with the sum of the quantities to date on all of the source documents for that item.

The resident engineer is responsible for the accuracy of a progress pay estimate. By approval, the resident engineer verifies that the quantities are correct, and that data submitted conforms to the policies of Caltrans. All entries on Form CEM-6004, “Contract Transactions Input,” must be checked by other Construction personnel for errors such as transposition and wrong numbers.

The resident engineer must review and approve each monthly estimate before district Construction office staff can process it for payment. To expedite handling, the resident engineer need not sign the estimate itself to indicate approval. Approval may be by telephone. Confirm telephone approval by sending a memo or a “pre-verification of pay estimate” form letter to the district Construction office.

Refer to Section 5-103, “The Contract Administration System,” of this manual for technical details on the production of estimates.

3-906A Bid Items

Include all bid item work completed satisfactorily in accordance with the contract in progress payments. Do not include in progress payments preparatory or organizational work such as assembling equipment, shop work, forming, or crushing or stockpiling of aggregate unless provided for in the special provisions. Do not pay for material placed or installed for which you have not obtained the required evidence of acceptability, such as Form TL-0029, “Report of Inspection of Material”; Form TL-0624, “Inspection Release Tag”; certificate of compliance; or acceptance tests.

For items bid on a unit basis, include in progress payments work that is substantially complete. Withhold a sufficient number of units to cover the value of the incomplete incidental work. In each case, a source document must be on file showing the details of the quantity’s determination.

Refer to intermediate source documents for items that are bid on a unit basis with a fixed final pay quantity, such as structural concrete and bar reinforcing steel (bridge), to show how partial payment was estimated. Withhold units of work to cover the value of incomplete incidental work. Base the withheld amount on a force account analysis of the remaining incidental work.

The following examples are listed to illustrate the procedure for partial payments:

1. Mobilization item

The Contract Administration System (CAS) will automatically calculate and enter partial payments for the item, “Mobilization.”

2. Maximum value items

Handle items for which maximum payment is limited until after a time fixed in the contract as follows:

- Include on the estimate the quantities completed in the same manner as for any other bid item. The quantity will be extended at the bid price and added to the total of work done.

- The system will make a deduction for any overbid.

- The system will return the deduction at the time set forth in the contract.

3. Roadway excavation

In normal situations, material is excavated, hauled, placed in final position in embankment, and compacted, but slope finishing is not done. This is considered incidental work, and a quantity may be withheld to cover the value of the work remaining.

4. Aggregate for subbase and base

Material may be produced, hauled, placed, and compacted, but final trimming to tolerance has not been performed. This is incidental work, and a quantity may be withheld to cover the value.

5. Portland cement concrete pavement

Concrete may be in place and cured but not ground to meet surface tolerance. Grinding is incidental work, and units may be withheld to cover the estimated cost.

6. Sewers and irrigation systems

Pipe may be placed and backfilled but not tested. Withhold units to cover this work.

7. Fence

Posts and wire or mesh may be in place and securely fastened but bracing wires not completed. Withhold units to cover this incidental work.

8. Structural concrete, bridge, final pay quantity

Bridge construction generally requires erecting falsework to carry dead loads of concrete (or steel) members until they become self-supporting. When falsework supports the superstructure concrete of box girder or slab bridges, make partial payments for the bid item.

When the soffit plywood is complete in place, make a partial payment equivalent to 35 percent of the projected superstructure concrete volume.

Withhold 5 percent for removal of the falsework materials and the final surface finishing of concrete.

9. Bar reinforcing steel

Pay for bar reinforcing steel that is complete and in place in the forms. It does not have to be encased in concrete before payment is made.

10. Structural steel, final pay quantity

Steel placed is paid by units erected and in place. Withhold units to cover incidental work such as additional bolting and welding.

For work that includes an item for “furnishing,” make no payment for furnishing until all contract requirements have been met, including acceptability of the material and delivery to the project. However, payment may be made for materials on hand, as covered in Section 3-906E, "Materials on Hand," of this manual, for items that qualify and meet specified eligibility requirements. Refer to the Bridge Construction Records and Procedures manual for additional instructions.

For lump sum bid items, if a schedule of values is required, refer to Section 3-906B, “Schedule of Values,” of this manual. Certain lump sum bid items may include specified payment provisions that describe payments to be made as work on the item or project is completed. Otherwise, pay a percentage of the lump sum bid price as work progresses. Use for this calculation the ratio of the number of working days an item of work has been in progress divided by the estimated total number of working days required to complete the item work. Be aware that such a simplified method might not reflect the value of the work actually completed. Reach an equitable agreement with the contractor for the basis of determining progress payments on lump sum items in such cases.

If any work or material on hand paid for on a previous monthly estimate loses value through loss, damage, or failure to function, deduct units representing the lost value from the following monthly estimate. Another example is storm damage requiring repair or replacement in accordance with Section 5-1.39B, “Damage Caused by an Act of God,” of the Standard Specifications.

Do not pay for item work added by change order until the change order is approved. However, payment for bid item overruns that are not the result of a change in the contract may be included in the monthly estimate.

3-906B Schedule of Values

A schedule of values is required for specific lump sum bid items such as electrical systems. Building construction will also be a lump sum bid item and will require a schedule of values as specified in the special provisions. Structure Construction will provide a technical review to verify that progress payments can be based on the value of the work in place.

3-906C Extra Work

Do not pay for change order work until the change order is approved. Refer to Section 3-403, “Changes and Extra Work,” Section 3-906D, “Interest,” and Section 5-3, “Change Orders” of this manual, for further information on change orders providing for extra work.

3-906D Interest

Section 9-1.03, “Payment Scope,” of the Standard Specifications provides for interest to be paid on unpaid and undisputed progress payments, payments after acceptance, change order bills, claim payments, and awards in arbitration.

Keep a log of the dates change order bills are received, rejected, and resubmitted. In a timely manner, process all change order bills, and fully document reasons for rejecting change order bills.

Make interest payments for late payments by change order as a payment adjustment at lump sum. Refer to Section 5-3, “Change Orders,” of this manual for more information.

3-906E Materials on Hand

Pay for acceptable materials on hand with individual material costs of at least $50,000 or at least $25,000 for requestors certified as a disabled veteran business enterprise, disadvantaged business enterprise or small business, provided that all specified conditions have been met. Do the following:

- Give the contractor Form CEM-5101, “Request for Payment for Materials on Hand.”

- The contractor must initiate payment by submitting in duplicate a properly completed Form CEM-5101. Make no payment for any material if the contractor has not requested payment on the Caltrans-furnished form. The contractor must submit a request 1 week before the end of the estimate period for each estimate. Each request must represent the current status of materials on hand at the time the request is made. Do not honor a request if it does not represent the actual amount on hand.

- Upon receipt of a request for payment for materials on hand, the resident engineer must check that it is filled out properly, meets specified eligibility requirements, and that the contractor attached evidence of purchase. Check on requestor’s certification for a disabled veteran business enterprise, disadvantaged business enterprise, or small business when the material cost is $25,000 to $50,000. When the contractor’s supporting evidence of purchase shows that a discount has been allowed, reduce the payment for materials on hand by the amount of the discount.

- Before processing a materials-on-hand request, inspect all materials for acceptability. Materials must have a certificate of compliance or Form TL-0029, “Report of Inspection of Material.” Form TL-0029 is evidence that the material was inspected at the source. In general, accept only completely fabricated units, ready for installation on the project with the following exceptions:

- Piling—Steel plate used for steel pipe piling and driven steel shells filled with concrete and reinforcement as described in Section 49, “Piling,” of the Standard Specifications may be considered acceptable as raw material. However, pay for such material as raw material only until shop fabrication of the pile is 100 percent complete. After shop fabrication is complete, the estimated fabricated value may be paid, subject to other specified restrictions and administrative guidelines.

- Structural Steel—Structural steel used in steel structures as described in Section 55, “Steel Structures,” of the Standard Specifications, may be considered acceptable as raw material. However, pay for such material as raw material only until shop fabrication of a usable member, such as a girder or other shape ready for shipment to the job site, is 100 percent complete. After shop fabrication is complete, the estimated fabricated value may be paid, subject to other specified restrictions and administrative guidelines.

- Sign Structures—Structural steel used in overhead sign structures as described in Section 56, “Overhead Sign Structures, Standards, and Poles,” of the Standard Specifications, may be considered acceptable as raw material. However, pay for such material as raw material only until shop fabrication of a usable member, such as a sign frame or other member, is 100 percent complete. After shop fabrication is complete, pay for the estimated fabricated value, subject to other specified restrictions and administrative guidelines.

- Verify proper storage of materials listed on Form CEM-5101, "Request for Payment for Materials on Hand," in accordance with the following procedures:

3-906E (1) Materials at the Project

For all valid requests for material located at or near the project, determine whether the materials are stored in conformance with the contract. To conform to this requirement, the contractor may have to store materials in fenced areas with locked gates, in locked warehouses, or in areas where it is improbable that materials would be lost from any cause. In addition to having controlled storage, the contractor is required by the Standard Specifications to provide proper storage and handling so that the materials do not become damaged or contaminated. For stored materials with water pollution potential, the contractor must establish and maintain water pollution control measures. Call any indication of improper storage to the contractor’s attention. Withhold payment for materials on hand until the materials are properly stored.

Do not pay for material accepted on the basis of certificates of compliance until such certificates have been received.

The resident engineer or an assistant resident engineer must review Form CEM‑5101 to verify that the request is acceptable.

3-906E (2) Materials Not at the Project

For materials not delivered to the job site, obtain evidence, and establish the fact of purchase, proper storage, acceptability, accessibility, and other factors. Materials Engineering and Testing Services (METS) maintains representatives in major industrial areas and provides inspection in all other areas for this purpose. The following is the procedure for requesting METS's assistance:

- If it is not practical for the resident engineer or assistant resident engineers to verify quantity, quality, location and proper storage, send the duplicate copy of the Form CEM-5101 to METS.

- Upon receipt of Form CEM-5101, METS will immediately notify the appropriate inspection office or offices. The METS representative will notify the resident engineer directly using Form TL-0649, “Inspector's Report of Material on Hand,” or TL-6037, “Fabrication Progress Report,” that the material has been inspected and that it is in acceptable condition and properly stored. METS will use Form TL‑6037 for structural steel, precast prestressed concrete members, or sign structures. For other products, METS will use Form TL-0649.

METS may also indicate on its correspondence the percentage complete of shop fabrication on various structural components. This figure is given for the purpose of reporting progress on the affected items. Do not use it to increase payment for materials on hand during fabrication.

- Upon receipt of the Form CEM-5101 and percentage-complete verification, the resident engineer can approve the partial payment. The contractor must submit a new Form CEM-5101 for each estimate, and the percentage-complete procedure must be followed. However, it is possible METS may not be able to respond in time for payment on the estimate. METS gives priority to new or changed requests. Therefore, for requests that have not changed since a previous submittal, resident engineers may approve subsequent payments in the absence of any METS reports to the contrary.

On the monthly progress pay estimate, enter the total value of acceptable material as material on site regardless of storage location. Use Form CEM-5105 to summarize, authorize and document material on hand payments.

The maximum payment for materials on hand should be such that, when the estimated placing and other remaining costs of the work are added, the contract price is not exceeded. The purpose of this is to prevent payment of more than the contract price for the materials and to leave sufficient funds in the item to complete the work.

3-906F Withholds

3-906F (1) Progress Withholds

Progress withholds are usually determined by noncompliant or unsatisfactory progress. Whenever a contractor’s performance is unsatisfactory, the resident engineer notifies the contractor of the apparent failure.

3-906F (1a) Noncompliant Progress

Progress is determined by comparing the contractor’s actual progress with the curve on Form CEM-2601, “Construction Progress Chart (Oversight Projects).” This requires calculation of the percentage of work completed and the percentage of time elapsed. If the plot of these percentages falls on or above the curve on Form CEM‑2601, progress is considered satisfactory. Otherwise, it is considered unsatisfactory except under extenuating circumstances. Refer to Section 9-1.16E(2), “Progress Withholds,” of the Standard Specifications for noncompliant progress conditions.

After each progress estimate, update Form CEM-2601. The Contract Administration System (CAS) uses the formula contained on this form to determine progress. For a description of this process, refer to Section 5-1, “Project Records and Reports,” of this manual.

The contractor’s progress is usually considered unsatisfactory when the contractor’s progress curve falls below the curve of the contract progress chart or when successive points on the contractor’s progress curve indicate the contractor’s progress rate will soon fall below the curve.

The percentage of work completed is determined by dividing the amount on the line titled “Total Work Completed” on the “Project Record Estimate” by the “Authorized Final Cost” on the “Project Status.” CAS calculates this percentage. Calculations for percentage of work completed for Type 1 plant establishment projects are an exception. Calculations are shown in Section 3‑906F (1b), “Plant Establishment Work,” of this manual.

CAS computes the percentage of contract time elapsed by dividing the number of working days elapsed to the date of the progress estimate, by the original working days specified in the contract plus “Total time extension days approved to date,” on Form CEM-2701, “Weekly Statement of Working Days.”

Whenever the contractor fails to prosecute the work adequately, determined by the plot of actual progress and your concurrence, you must notify the contractor of the apparent lack of progress. If you judge that the work on the remaining work activities will not be completed by the “computed date for completion” as defined in Section 3-804, “Time,” of this manual, you must request that the contractor submit a revised schedule showing how the balance of the work will be carried out.

Occasionally, the resident engineer has information indicating that the percentage of time elapsed is different from that which CAS will calculate. The usual reason for this is that pending time extensions have not yet been approved and entered into the system. The percentage of time elapsed can be calculated using the anticipated time extension in the formula described previously. The resident engineer must document the calculated percentage of time elapsed as well as the reasons therefore. Enter the calculated percentage of time elapsed in the appropriate place on Form CEM-6101, “Project Record—Estimate Request.” CAS will calculate satisfactory or unsatisfactory progress based on this figure.

Whenever the district believes the contractor’s bonding company should be notified of unsatisfactory progress, advise the Division of Construction of the reasons supporting such an action. If appropriate, the district will initiate the notification.

If the district believes the lack of progress on a contract justifies a meeting, the district arranges a conference to be attended by the contractor’s representatives, the bonding company, and Caltrans. If appropriate, the Division of Construction will arrange the conference. For more information, refer to Section 3-808, “Contractor’s Control Termination,” of this manual.